How it works

Empowering Your Business Growth with Tailored Loan Solutions

Our company provides easy and affordable loan solutions to help your business grow. We understand that every business has unique needs, so our loan options are tailored to fit your specific requirements. Whether you’re looking to expand your business or manage cash flow, we’re here to support you. Our simple and transparent application process ensures you get the necessary funds quickly and easily, so you can achieve your business goals.

We are here to help

Facing Debt Together Makes It Easier.

It’s Possible: Faster and More Secure

01

Arrange a Free, Confidential Meeting with a Debt Settlement Professional.

02

If eligible, we offer your company immediate cash flow, allowing us the time to collaborate with you.

03

Eliminate Your Debt in 6 to 8 Months and Ensure a Bright Future for Your Business.

Our Services

Here’s What Makes Us Different.

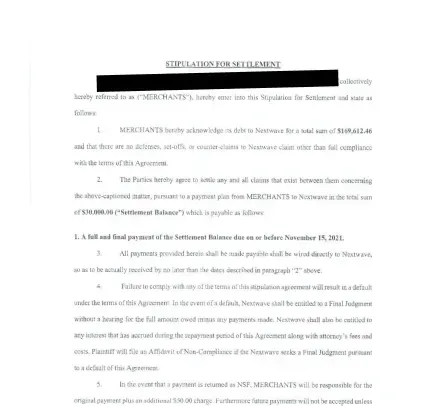

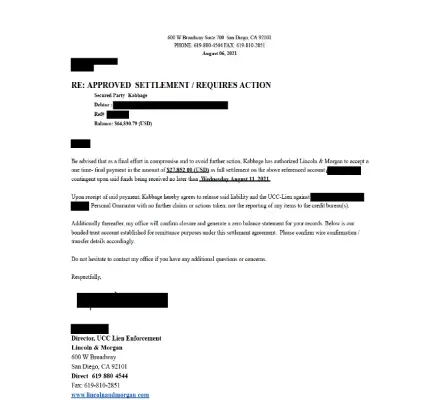

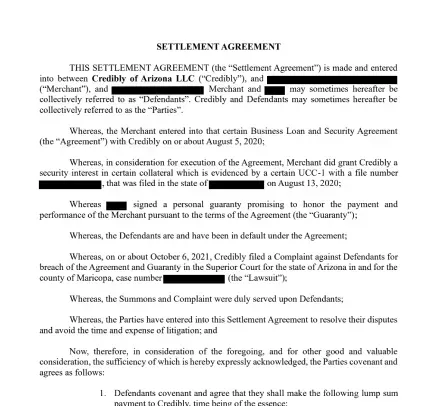

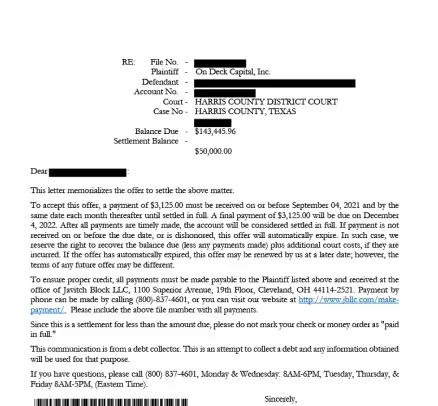

MCA Loan Negotiation

We swiftly negotiate inflated daily/weekly payments for business owners. Leveraging our extensive knowledge, our team often reaches settlements within 6–8 weeks..

Trusted Legal Experts Network

Our legal team, in collaboration with a network of trusted attorneys nationwide, has successfully managed hundreds of cases.

Specific Solutions

With expertise in small and medium-sized business debt solutions, our experienced specialists will develop a tailored plan that aligns with your goals, offering manageable repayment options while preserving your credit score.

The Support You Need

Our team develops corporate debt repayment plans with manageable terms, aiming for debt-free status within 6–12 months. We offer emergency relief and on-demand support to minimize stress.